Punjab’s recent unveiling of the Green Vehicle Tax sparks a crucial dialogue on sustainable transportation practices and environmental responsibility. This innovative measure, designed to address the pressing issue of vehicular emissions, signals a significant shift in the state’s approach to combating pollution. By incentivizing the adoption of eco-friendly vehicles and penalizing older, more polluting models, the Green Vehicle Tax underscores a pivotal step towards a cleaner and greener future. The implications of this tax reach far beyond simple fiscal policy, offering a glimpse into Punjab’s commitment to fostering a more sustainable society and economy.

Green Tax Implementation Details

Upon its official commencement in 2023, Punjab’s new green vehicle tax marks a significant step in the state’s efforts to combat vehicular emissions and promote environmental sustainability.

The implementation of this tax brings various benefits, including a reduction in harmful vehicle emissions that contribute to air pollution. By discouraging the use of older, more polluting vehicles through higher tax rates, Punjab aims to incentivize the adoption of eco-friendly transportation options.

This initiative aligns with the broader goal of creating a cleaner and greener environment for all residents. Through the green tax, the state seeks to encourage responsible vehicle ownership and contribute to a healthier ecosystem for current and future generations.

Tax Rates for Non-Commercial Vehicles

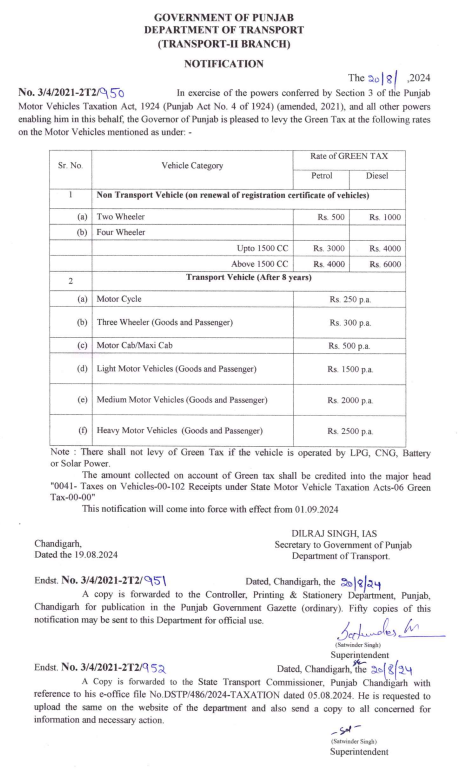

With the introduction of Punjab’s new green vehicle tax, non-commercial vehicles face varying tax rates based on their type and emissions.

Two-wheelers are taxed at Rs 500 annually for five years, while four-wheelers with petrol engines below 1500 cc are charged Rs 3,000 per year.

Diesel vehicles under 1500 cc face a tax of Rs 4,000 annually, with petrol vehicles over 1500 cc and diesel vehicles over 1500 cc taxed at Rs 4,000 and Rs 6,000 yearly, respectively.

Electric vehicles are exempt from the green tax, promoting pollution reduction strategies.

The tax rates aim to incentivize the adoption of eco-friendly options, such as electric and hybrid vehicles, while discouraging the use of high-emission vehicles to achieve a cleaner environment.

Tax Rates for Commercial Vehicles

Continuing the discussion on tax rates within Punjab’s green vehicle tax framework, the focus now shifts to commercial vehicles.

- Eight-year-old motorbikes: Rs 250 annually.

- Three-wheelers: Rs 300 per year.

- Maxi cabs: Rs 500 annually.

- Light motor vehicles (LMV): Rs 1,500 yearly.

- Medium vehicles: Rs 2,000; Heavy vehicles: Rs 2,500 yearly.

Commercial vehicle exemptions are not explicitly mentioned, implying that all commercial vehicles are subject to the green tax.

Tax collection methods include regular audits and online platforms for seamless payment processing.

The differentiation in tax rates based on the vehicle’s size and type reflects an attempt to align taxation with emission levels and promote the adoption of eco-friendly transport options.

Revenue Projection and Allocation

The revenue projection and allocation aspect of Punjab’s green vehicle tax scheme plays a crucial role in understanding the financial implications and intended utilization of the funds generated through this environmental initiative.

With an anticipated revenue of Rs 34.40 crore, transparency in revenue allocation is essential to ensure accountability and effectiveness. These funds are earmarked for various environmental initiatives, including public transport enhancements, pollution control measures, renewable energy projects, and campaigns on vehicle emissions.

However, it is vital to note that the green tax revenue may not fully cover significant subsidies like the annual Rs 650 crore cost of free transport for women travelers, indicating potential challenges in funding comprehensive environmental programs solely through this tax mechanism.

Compliance and Enforcement Measures

Rarely do environmental policies come without the need for stringent compliance and enforcement measures, and Punjab’s new Green Vehicle Tax scheme is no exception.

Vehicle owners must adhere to specific regulations to ensure the success of this initiative.

- Tax Registration: Mandatory registration for the green tax is required for all vehicle owners in Punjab.

- Penalty Enforcement: Non-compliance with the tax regulations will lead to fines and penalties.

- Regular Audits: Audits will be conducted periodically to monitor and enforce tax compliance.

- Online Payment Platforms: Online portals have been established to facilitate convenient tax payment processing.

- Emissions Monitoring: The government will utilize emissions data to effectively enforce compliance with the green tax regulations.

Rationale for Green Tax Introduction

With the ever-increasing concern over escalating pollution levels and the pressing need for sustainable transportation solutions, Punjab introduced the Green Vehicle Tax as a strategic measure to address the environmental challenges posed by vehicular emissions.

The rationale behind this tax lies in promoting environmental benefits by incentivizing the adoption of eco-friendly vehicles and reducing air pollution.

Additionally, the revenue generated from the green tax will be channeled towards enhancing public transportation infrastructure, investing in pollution control measures, supporting renewable energy projects, and conducting awareness campaigns on vehicle emissions.

Impact on Vehicle Choices and Environment

Following the implementation of Punjab’s Green Vehicle Tax, there has been a discernible shift in consumer behavior towards vehicle choices, significantly impacting the environment.

- Increased interest in eco-friendly alternatives like electric and hybrid vehicles.

- Decline in sales of traditional petrol and diesel vehicles.

- Rise in demand for vehicles with lower emissions.

- Adoption of sustainable transportation options.

- Consumer preference for newer, less polluting vehicles to avoid higher green tax rates.